How To Guides - Why you should take out boiler insurance

The Importance of Boiler Insurance: Protecting Your Home and Wallet

As our reliance on technology-based conveniences increases, their maintenance and longevity become essential for our comfort and peace of mind. Among the central components of our households is the boiler system, an appliance we often overlook until something goes wrong. This blog post aims to illuminate why boiler insurance can truly be a worthy investment.

Understanding the Essential Role of a Boiler

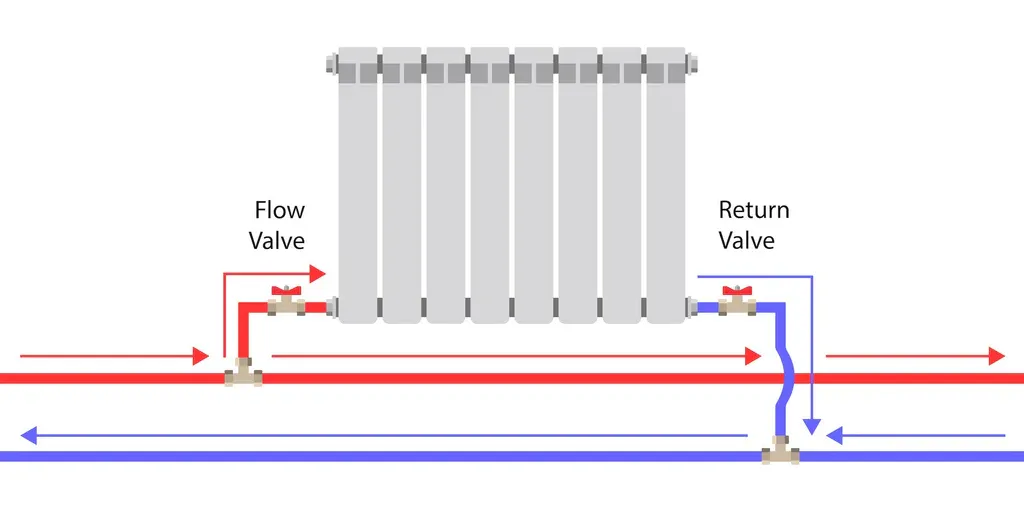

Before diving into the reasons for boiler insurance, let's introspect on the pivotal role a boiler plays influencing not only the rest of our home systems but our quality of life. A boiler provides us with central heating, functioning water, and in some cases, energy for cooking utilities. The necessity of these components is indisputable, and the implications of boiler failure can be quite disconcerting, particularly in colder months, often leading to unwanted cold showers, an uninviting home, or worse, a hefty repair bill.

Boilers are a vital component of any household, However, like any other appliance, boilers can suffer from wear and tear, breakdowns, and unexpected malfunctions. This is where boiler insurance comes into play, providing homeowners with peace of mind and financial protection. In this blog, we'll explore the reasons why investing in boiler insurance is a smart decision.

1. Cost-effective in the long run:

Let's face it—boiler repairs or replacements can be expensive. As boilers age, the likelihood of breakdowns increases. Boiler insurance ensures that you're covered in the event of an unexpected fault, sparing you from significant repair bills or the need to replace the entire appliance. By paying a relatively small premium each month, you can save a substantial amount of money over time.

2. 24/7 emergency assistance:

Boiler breakdowns don't always happen at convenient times. Imagine waking up to a freezing cold home or returning from vacation to find no hot water. With boiler insurance, you can contact your provider's helpline for immediate assistance, 24/7. Qualified engineers are dispatched to your home to diagnose and rectify the issue promptly, ensuring that your heating and hot water are restored as quickly as possible.

3. Expert repairs and maintenance:

When it comes to boiler repairs, it's essential to hire qualified professionals who can diagnose the problem accurately and fix it safely. Most boiler insurance policies offer access to a network of skilled engineers who are experienced in repairing a wide range of boiler models. This ensures that your boiler is in the hands of experts, reducing the risk of further damage caused by amateur repairs.

4. Peace of mind:

Worrying about potential boiler breakdowns can be stressful, especially during colder months when heating is essential. Boiler insurance gives you peace of mind, allowing you to relax, knowing that any potential issues will be addressed promptly and professionally. It's a smart investment in your home's comfort and your family's well-being.

5. Maintenance services and inspections:

Some boiler insurance policies also include regular maintenance services and inspections. These preventive measures help identify and address potential problems before they become major issues. Regular servicing can increase the lifespan of your boiler and ensure its optimal performance, saving you money in the long run.

6. Coverage for additional parts and labor:

Boiler insurance typically covers not only the cost of parts but also the labor required for repairs or replacements. This coverage is crucial, given that the cost of labor can often add up to a significant portion of the overall repair bill. By having both parts and labor covered, you won't have to worry about unexpected expenses.

Conclusion:

Investing in boiler insurance is a wise choice for homeowners looking to protect their homes and budgets from unforeseen boiler breakdowns. With coverage for repairs, emergency assistance, and maintenance services, boiler insurance offers peace of mind and financial protection. By choosing the right policy, you can ensure that your home and loved ones stay comfortable and warm all year round, without having to worry about costly boiler repairs.

Remember, prevention is better than cure, and boiler insurance is an essential tool for safeguarding the heart of your home while keeping your wallet intact.